The chatter over whether a college degree in the US is worth it has been going around for quite some time now. Igniting the debate is new research from the Foundation for Research on Equal Opportunity (FREOPP) which shows that many students make a negative return on investment (ROI) on their tuition.

In its report, FREOPP said, “While prospective students often ask themselves if college is worth it, this report shows the more important question is when college is worth it.”

Here are the key takeaways from the report and the methodology.

What Does the New Study Tell Us About College Degree ROI?

The FREOPP report estimated ROI for 53,000 degrees and programs spread across universities and fields. It defines ROI as “the increase in lifetime earnings that a student can expect when they enroll in a certain degree program, minus the costs of tuition and fees, books and supplies, and lost earnings while enrolled.” The measure also accounts for the risk that some students won’t finish their education and leave it midway.

Is Your College Degree Worth It? It Depends on the Field of Study

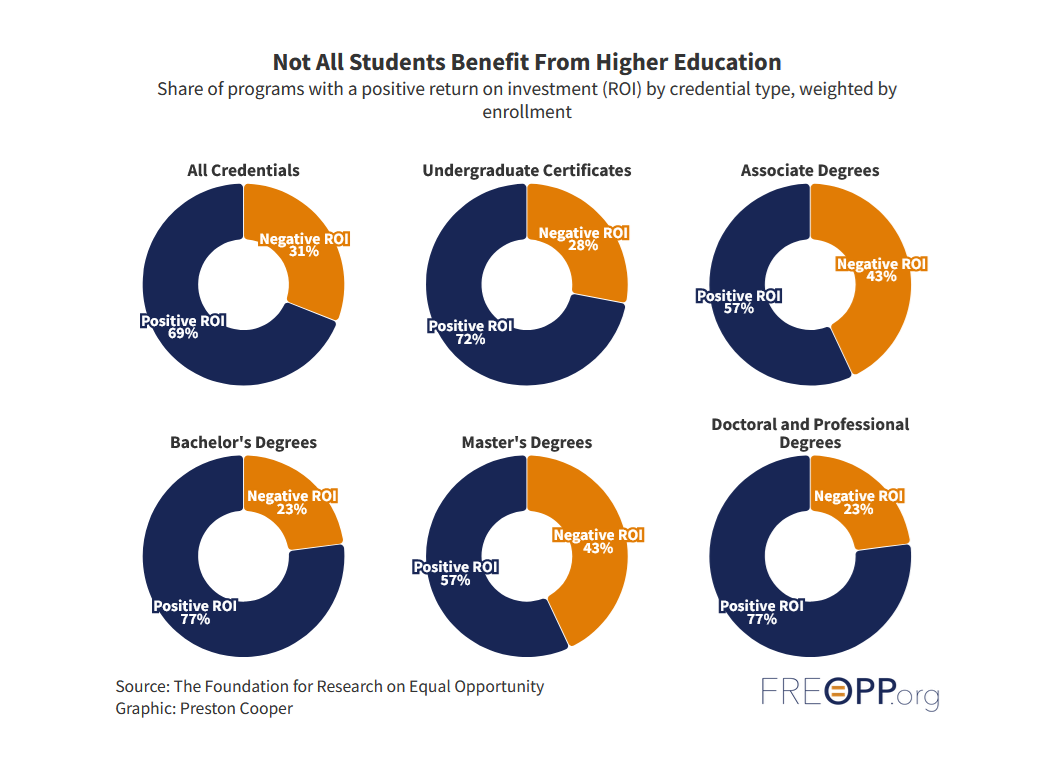

The research shows the proportion of college degrees generating positive ROI is higher than those generating negative ROIs as 69% of students end up making positive payoffs. However, in general, bachelor’s degrees, doctoral, and professional degrees do better, and over three-fourths generate positive ROI. In contrast, the percentage of master’s and associate degrees that generate positive ROI is a mere 57%.

There are also divergences based on the field of study. For instance, bachelor’s degrees in nursing, computer science, engineering, and economics can have a positive ROI in excess of $500,000 – which is over thrice the $160,000 that the average bachelor’s degree generates.

However, courses in fine arts, psychology, education, and English don’t generate positive payoffs, and even if they do it is below average. Even biology is a low ROI course with a caveat – those students who complete medical school after a major in biology earned attractive ROIs.

ROIs Also Depend on the College

The choice of college also impacts the ROI that students eventually make. For instance, the average ROI on a bachelor’s degree in accounting and related services from Strayer University-District of Columbia generated a negative ROI of 123,298 while the same degree from Georgetown University led to a positive ROI of over $4 million (likely due to both networking and prestige). We see a similar trend across all courses and there is a massive divergence in payoffs based on the institution.

The relationship between college tuition fees and payoffs is complicated though and the research shows that colleges that have the highest net tuition costs (over $16,000 per year) also have the highest median ROI.

— Kimberly Klacik (@kimKBaltimore) November 1, 2022

Are Trade Courses Worth It?

The report also contrasts college degrees – some of which can cost a fortune – to trade courses. In fact, the median ROI for technical trades is almost twice that of a bachelor’s degree.

According to the report, “Undergraduate certificates in the technical trades — which include vehicle maintenance and repair, precision metal working, HVAC technology, and electrical and power transmission installation — are more lucrative than a bachelor’s degree.”

Only two trade courses – an associate program in education and public service, and a certificate in cosmetology – generated negative ROIs.

College Education Costs Have Soared in the US

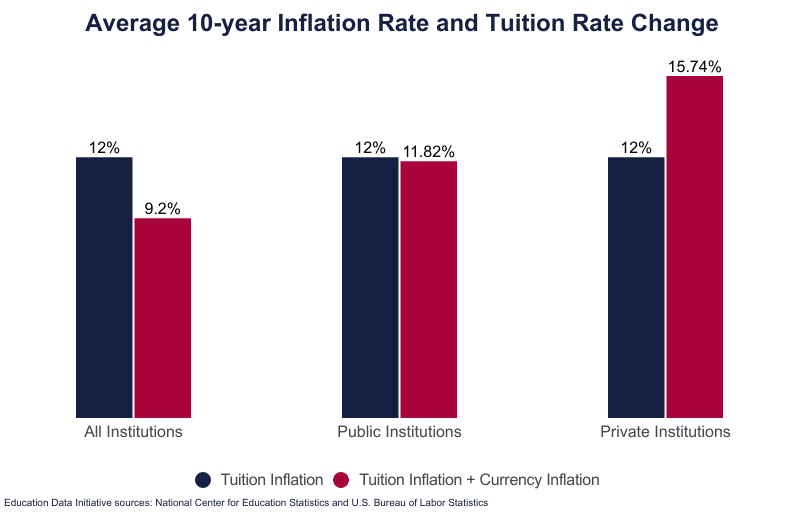

Inflation in the US is still staggeringly high after peaking at a multi-decade high of 9.1% (annualized) in June 2022 and some products and services are even worse. College tuition inflation is one of the worst culprits as it has risen at a CAGR of 12% between 2010 and 2022 according to the Education Data Initiative (EDI).

The EDI offers several hypotheses for the steep rise for the steep rise in education, including the “Golden Ticket Fallacy” which it describes as “Believing any college degree would result in improved future earnings results in college students doing less in-depth research on the cost of college, including tuition.”

However, as the FREOPP research shows, not all college degrees are a “golden ticket” and some are duds, and completing them is not financially rewarding.

College education not making positive payoffs for many students could also negatively impact the US economy as these students could have otherwise earned (and thereby spent) more money and contributed more to the economic activity.

Student Loans Have Become a Big Problem

On a related note, higher college fees and poor payoffs have also been adding to the problem of higher student debt which according to Federal Student Aid (an office of the Department of Education) topped $1.6 trillion in 2023.

There are financial as well as political repercussions of rising student debt. President Joe Biden was considering forgiving student loans that could have benefited 43 million Americans. However, the move was struck down by the US Supreme Court. He claims that he is still trying to forgive student debt using other methods, though he hasn’t made much progress as of yet.

Canceling student loans could mean that the US national debt which has already surpassed the national GDP would rise to even dangerous levels.

All said, if you are someone who aspires to get a college degree it might be prudent to weigh the payoffs and opt for courses that could generate good ROIs. Given the rising cost of education, a college degree is one financial decision that could have a bearing on one’s life years after completing education. The hiatus is well illustrated by the growing student loan burden where millions people are struggling to pay down their loans even after years of graduating.