After three years in the shadows, Keith Gill, the internet celebrity investor, better known as Roaring Kitty, who helped spark the epic GameStop short squeeze of 2021, has reemerged on social media.

On Sunday night, Gill’s long-dormant “Roaring Kitty” account on X (formerly Twitter) suddenly came back to life with a cryptic image of a gamer sitting up in a chair. This mysterious meme kicked off a wave of speculation and renewed interest in the so-called “meme stock” phenomenon he helped unleash during the pandemic.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

The GameStop Saga and Roaring Kitty’s Role

For those unfamiliar, Keith Gill became popular in January 2021 due to his outspoken bullishness on the stock of the struggling videogame retailer GameStop. Under the usernames “Roaring Kitty” on YouTube and “DeepF*ckingValue” on Reddit’s WallStreetBets forum, Gill passionately made the case that GameStop’s stock (GME) was being undervalued by the market.

At the time, GameStop was viewed by Wall Street as a fading brick-and-mortar business doomed by consumers’ ongoing transition to cloud-based games. Many prominent hedge funds like Citron Research and Melvin Capital had taken massive short positions on the stock, betting that it would keep plummeting especially at a time marked by social distancing protocols and physical store shutdowns.

Eventually, these bets got so large that they shorted many more shares than the total number of outstanding shares. Because the only way to close a short position is to buy back the asset, this would soon become a massive issue for these hedge funds. In this kind of situation, if enough buying power pushes the stock up, short sellers are forced to start buying up shares, pushing the price up more and forcing even more short sellers to close their positions (by buying the stock). This feedback loop is called a short squeeze.

Gill’s persistent touting of GME helped spark a buying frenzy among retail traders who saw an opportunity to squeeze deep-pocketed short sellers out of their positions. Gill’s campaign began with the simple belief that GameStop stock was undervalued but it quickly transformed into a massive effort to short-squeeze the massive hedge funds trying to drive GME into bankruptcy.

As more and more investors piled in, GME shares skyrocketed by more than 1,000% in just a few weeks, peaking at $483 on January 28th.

This triggered epic losses for the hedge funds that were shorting the stock back then, with estimated damages of over $5 billion. The David vs Goliath narrative of retail traders taking on powerful Wall Street firms captivated the world and made Gill an anti-establishment folk hero.

The Aftermath and Roaring Kitty’s Long Silence

In the aftermath, Gill was called to testify before Congress about his role, where he pushed back on lawmakers’ claims that he was trying to manipulate the market. During his hearing, he said:

“The idea that I used social media to promote GameStop stock to unwitting investors is preposterous.” Gill maintained that his massive GME position was simply a value investment based on public information and his belief in the company’s turnaround potential under the leadership of Chewy’s founder Ryan Cohen.

Also read: What is the Next Gamestop Stock? Top 10 Contenders

“I was abundantly clear that my channel was for educational purposes only and that my aggressive style of investing was unlikely to be suitable for most folks checking out the channel,” he further argued.

— Roaring Kitty (@TheRoaringKitty) June 19, 2021

After that testimony in February 2021, Gill largely disappeared from the public eye and posted what was his last social media interaction in June 2021 – a video of sleeping kittens. His years of internet silence only added to his mythical status among the meme stock crowd who appear to have been eagerly awaiting his return judging by their reaction to his post today.

The ‘Roaring’ Comeback

Last Sunday, Gill published his first X post since mid-2021 – a simple image of a video game player leaning forward that can be interpreted as a gesture of paying extra attention to what he is doing (or to the markets).

He kept sharing content on Monday in the form of a string of memes and video clips, including one of the Marvel villain Thanos grabbing the all-powerful Infinity Gauntlet.

Although the posts were quite cryptic, they immediately sent shockwaves through the meme stock universe. On Monday, shares of GameStop more than doubled at one point during the pre-market stock trading session, hitting $31 apiece before a volatility trading halt was triggered.

Also read: 10 Best WallStreetBets Stocks to Buy in 2024

Meanwhile, the stock of AMC Entertainment (AMC), another traditional subject of the meme-stock movement, spiked over by 70%.

These initial spikes also prompted rallies in other popular targets for retail investors like Blackberry and Koss Corp. Meanwhile, in the crypto space, Dogecoin and other meme cryptocurrencies were initially pumped as well.

In response to Gill’s reappearance, another controversial figure who contributed to the meme craze, Dave Portnoy, took the chance to channel his inner WWE showman and showed his support to the Roaring Kitty’s comeback.

“You wanna get nuts let’s get nuts! Every time I think I’m out they pull me back in!”

Why Did Roaring Kitty Come Back?

So, after staying off the radar for more than three years, why is Roaring Kitty suddenly coming back? Gill hasn’t given any explicit reason yet. Some speculate that he may just be capitalizing on his renewed celebrity status from the 2023 film “Dumb Money” which dramatized the GameStop saga.

Others think he could be setting the stage for a new round of meme stock mania. With GameStop’s board now being controlled by Ryan Cohen, perhaps Gill is seeing an actual change that a real turnaround could be playing out. GameStop did try embracing crypto before walking back on those plans, so future ties to the space are possible.

He may also be the opening shot for a new season of meme stock craziness completely disconnected from business fundamentals. After all, the proven ability of figures like him to activate retail investors into buying worthless stocks is a power that Wall Street can’t ignore anymore.

Implications for the Crypto Space: GME Coin Surges by Nearly 3,000%

Gill’s involvement in the crypto space has not been significant compared to the influence he has had on stock market issues like GME and AMC. However, the rise of meme coins and their latest bout in popularity may have brought him back as his widespread popularity among retail investors could position him favorably to reap the rewards if he chooses to endorse certain projects.

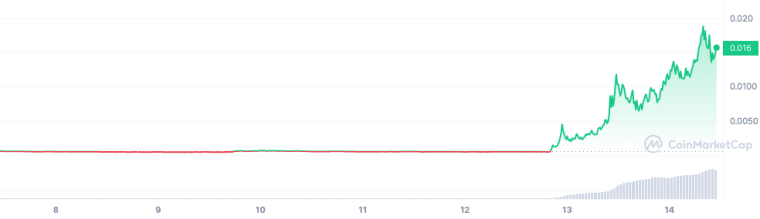

In this space, the biggest winner thus far has been the GME coin, which is a Solana-based token named after the company that Gill fearlessly endorsed back in 2021. According to data from CoinMarketCap, the price of the GME coin skyrocketed over 2,900% from around $0.0005 to as high as $0.015 following Gill’s reappearance on X.

As a result, the market capitalization of this token was propelled to more than $100 million and has probably made a handful of anonymous crypto enthusiasts rich in the past 24 hours or so. This could lure investors to the crypto space to cash in on another round of meme-stock craze to avoid being impacted by measures like a full-blown interruption of all buying activity, something that happened back in 2021.

Meanwhile, popular influencers like Andrew Tate also called on their followers to back Roaring Kitty’s return by loading up on GameStop shares and GameStop-adjacent cryptocurrencies. Tate announced a bold plan to sell $500,000 worth of Bitcoin (BTC) to fund meme asset purchases with a tweet:

“I’m taking Wall Street down, watch me. F*** ’em. F*** ’em all.”

While Roaring Kitty’s precise intentions remain unclear for now, his mere social media breadcrumbs already show his ability to catalyze market chaos and disrupt both traditional stocks and the crypto space. The meme stock master has returned, and the opening salvo of his second act seems to have been fired.